In the field of securities trading, a tick is the smallest possible movement in price for a particular security. It shows how much the value has changed. Traders pay close attention to ticks because they give important details about market behavior and price changes. Even a small tick can be very important, especially for traders who do lots of quick buying and selling to win money from tiny changes in prices.

The Mechanics of Ticks

Ticks, being the tiniest price movements in securities trading, are very important in financial markets. Their accuracy for measuring price changes is often as small as one cent for stocks on big exchanges such as NYSE and NASDAQ. Traders rely on ticks to understand market feelings and decide how they will invest their money. As an example, when a stock changes from $10.00 to $10.01, this is considered one upward tick that could imply bullish feelings. But if it drops from $10.00 to $9.99, then we call it a downward tick showing bearish feelings (Investopedia). We may think these small changes are not important but they can give a big understanding about how the market moves.

Besides being used for price tracking, ticks are also important signs for those involved in the market. Understanding ticks aids in comprehending short-term price actions as well as recognizing long-standing tendencies and patterns within the market. Through scrutinizing tick data, traders can detect alterations in supply and demand which assist them to foresee market changes and modify their tactics correspondingly. Additionally, ticks help traders to evaluate market liquidity and volatility. These are crucial factors in making trading choices and managing risks.

- Consideration: When analyzing tick data, it's essential to consider the context of market conditions and external factors influencing price movements.

- Caution: Relying solely on tick data without considering fundamental or technical analysis may lead to incomplete assessments of market dynamics.

Ticks and Market Dynamics

Market dynamics can be demonstrated by ticks, which are quiet but strong signs of investor feeling and trading action. If there is a run of upward ticks, it shows positive sentiment - this means that buyers are controlling the market and pushing prices up. On the other hand, if there's a series of downward ticks it shows negative sentiment - sellers are dominating causing prices to go down. These tick movements show how supply and demand in the market change, forming general feelings about the market.

Ticks have an effect on trading strategies and decision-making by traders. They pay close attention to tick data to spot trends and patterns, which helps them in creating successful trading methods as well as managing risk. Understanding the power of ticks within market dynamics aids in making better choices for traders, who can then grab chances that arise within the market.

- Fact: Ticks provide real-time feedback on market sentiment, allowing traders to react quickly to changing market conditions.

- Noteworthy: Market dynamics can vary across different securities and asset classes, requiring traders to adapt their strategies accordingly.

The Significance of Tick Size

The smallest amount by which the price of a security can change, called tick size, is very important for managing and maintaining fluidity in markets. For stocks listed on main exchanges, the usual tick size is one cent. However, different securities might have other tick sizes according to the rules of exchange and trading places. Tick size regulations are made to make price changes more uniform across securities types. This helps in improving market efficiency and decreasing differences between bid-ask prices resulting in better liquidity for the whole market system.

Traders also think about tick size when deciding on their trading methods and how to carry out trades. This is because the minimum price movement affects when they enter or exit a trade, along with profit potential. Knowing the importance of tick size helps traders to understand and manage complexities in financial markets, as well as improve results from trading activities.

- Consideration: Tick size regulations may vary between different jurisdictions and trading venues, impacting trading strategies and execution.

- Noteworthy: Tick size adjustments, such as those implemented by exchanges to enhance market liquidity, can have significant implications for market participants.

Tick Charts and Analysis

Tick charts present a distinct viewpoint about market actions by concentrating on price shifts according to ticks, not periods. This method gives traders a detailed understanding of the market's inner workings, allowing them to spot patterns and trends in daily trading sessions more efficiently. Tick charts react to market instability, unlike conventional time-based diagrams, offering a real-time understanding of business volumes and price unpredictability.

Incorporating tick charts into their analysis allows traders to spot potential trading opportunities and make more informed decisions. By observing the frequency and magnitude of tick movements, traders can assess market sentiment and anticipate shifts in supply and demand. Additionally, tick charts help traders identify key support and resistance levels, facilitating more precise entry and exit points for their trades.

- Fact: Tick charts are particularly useful for analyzing high-volume, fast-moving markets, such as futures and forex.

- Noteworthy: Different tick chart settings, such as tick size and time frame, can yield varying insights into market dynamics and trading opportunities.

Tick Data and Algorithmic Trading

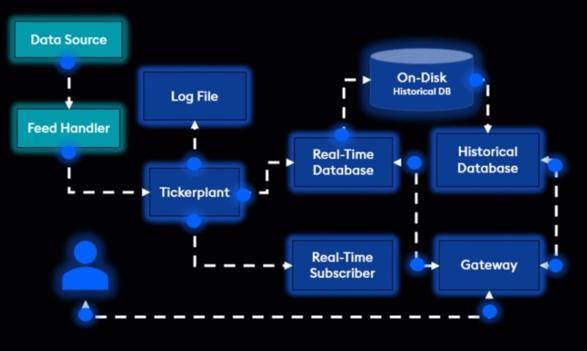

In the field of algorithmic trading, tick data is like the blood that keeps trading algorithms and strategies alive. Companies that do high-frequency trading depend on data feeds that give them ticks one by one, enabling them to make trades with unmatched quickness and accuracy. These algorithms examine big quantities of tick data in real time, using complex mathematical models and formulas to spot patterns or irregularities happening in the market.

Tick data is vital for algorithmic trading because it allows traders to take advantage of very short-lived chances in the market. By quickly handling tick data, systems for algorithmic trading can complete trades within a few milliseconds, using market flaws to make money. As technology keeps changing, tick data is predicted to have an even bigger part in algorithmic trading and this will shape how securities markets look in the future.

- Consideration: Algorithmic trading strategies based on tick data require robust risk management systems to mitigate potential losses during volatile market conditions.

- Noteworthy: Tick data analysis forms the foundation of quantitative trading strategies, providing traders with a competitive edge in the global financial markets.

Conclusion

To end, ticks are basic parts of securities trading. They show the smallest price changes for a security. Knowing about ticks and what they mean is very important for traders to do well in financial markets. Whether traders study tick graphs, watch over tick data, or use ticks in their systematic trading plans, they count on this detailed level of price info to decide with knowledge and profit from market changes.