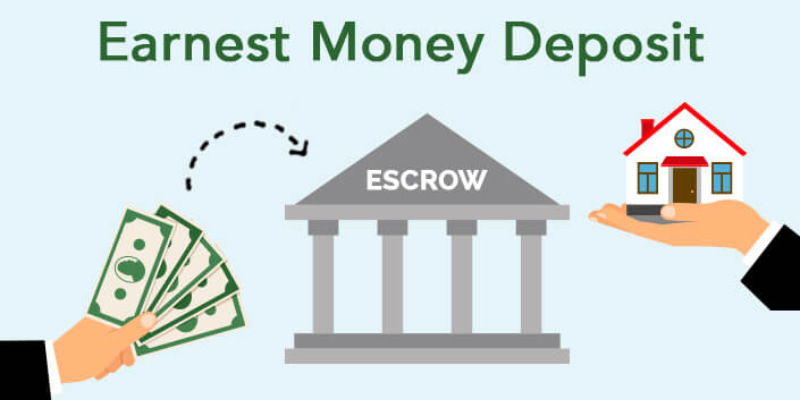

A buyer who has not put down an earnest money deposit can back out of the transaction at any moment. Earnest money is a down payment to secure the seller's interest in closing a sale. This ensures that the buyer will go through with the purchase of their house, bringing them some much-needed peace of mind. A down payment or earnest money deposit shows the seller that you're serious about making a deal, such as a house. Buyers can take their time obtaining financing, as well as with the title search, appraisal, and inspections, all of which must be completed before closing, thanks to the buyer being given access to the funds. Earnest money can be a down payment on a home, an escrow deposit, or a show of good faith.

Feelings And The Business

So, let's begin with the feelings involved in the deal. As a rule, the buyer is the one who feels aggrieved during the buying phase of a real estate deal. It is typically the purchaser. When a large sum of money is deposited into the seller's bank account, the sale is finalized in the seller's mind. On the other hand, the purchaser doubts the seller's honesty and fears that they are trying to cover up flaws. Until the moment when the buyer cannot close the sale, the buyer will typically feel as though there is more risk in the transaction than the seller does. An explosive situation can arise from the buyer's underlying anxieties, and the buyer's shouldering resentment over the failure to close.

How To Refund An Earnest Money Deposit To A Buyer

It is common practice for contracts to include a "contingency period" during which a buyer can back out if certain conditions are not met. It may relate to the loan, the appraisal, or the inspection. There could be a condition that the buyer sells their current residence first. Contract contracts commonly include cancellation clauses if the buyer does not meet specific conditions. For instance, let's say the buyer decides to have a house inspection done. The buyer finds that the furnace doesn't work during the inspection time, and the inspector confirms that the unit has reached the end of its useful life. Sometimes, a buyer may request the seller install a new heating system. The vendor may decline and demand that the transaction be terminated. The buyer may be entitled to refund the earnest money in this case.

When The Down Payment Is In Danger

Let's say the buyer has finished working through all conditions and released them all, and now it's time to figure out what to do with the earnest money deposit. The buyer may change their mind a few days before the closing date and opt out of the deal. Since the buyer knowingly and intentionally failed to close escrow, the seller, who may be upset by this turn of events, may be entitled to receive the earnest money deposit. What happens if the buyer balks at handing over the promised deposit? An uncooperative buyer could further complicate matters by refusing to sign any cancellation documents. A clause in the contract may prevent the seller from selling the property to another buyer. The seller is not permitted to be a party to more than one contract at once.

How Much Should I Put Down As A Down Payment?

Depending on local customs and the nature of the market, earnest money deposits might range from one percent to five percent of the purchase price. The typical down payment rises in seller's markets as more buyers compete for a less supply of properties.

Conclusion

To put it simply, earnest money is a down payment made by a prospective homebuyer. When parties exchange earnest money, they sign a contract outlining the terms under which the money can be returned. A common earnest money deposit is anywhere from one percent to ten percent of the purchase price, though the exact amount depends on the market. A buyer's earnest money deposit could be forfeited if they breach the terms of the purchase agreement. Nonetheless, a few caveats can be agreed upon, which help a buyer back out of a purchase and still keep their earnest money.